Thailand’s Sugar Exporters

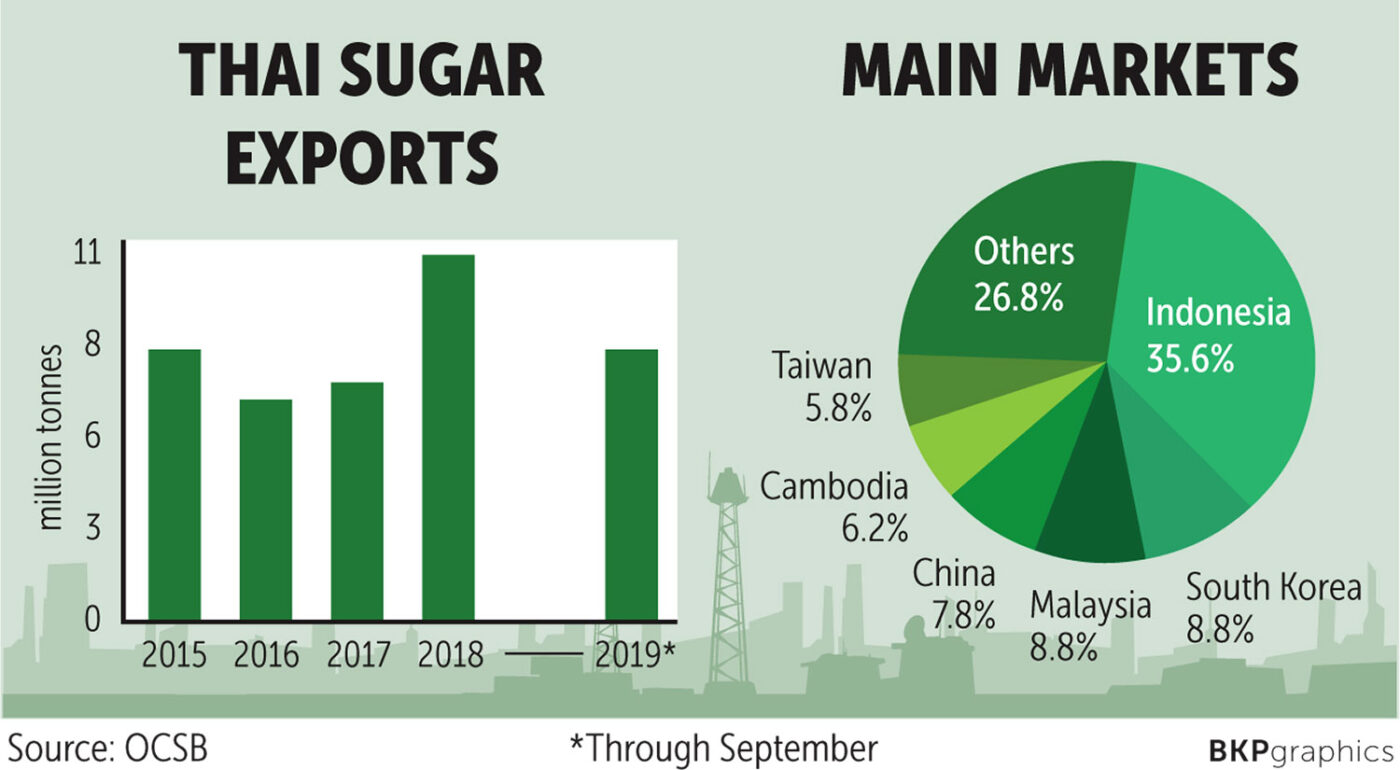

In 2024, Thailand is poised to maintain a strong position as a leading sugar exporter, with estimates suggesting the country could export approximately 4.7 million tonnes of sugar. This projection highlights the significant role Thailand continues to play in global sugar trade, particularly amidst a market grappling with tight sugar supplies and a surge in demand. However, several factors are influencing Thailand’s sugar production and export potential, including the weather conditions, sugar cane yields, and market trends that shape both domestic and export prices.

Challenges in 2024: Tight Global Supply and Quality Concerns

The global sugar market has experienced volatility, with a tight supply adding more pressure on producers. While Thailand has a solid track record of sugar exports, the challenges faced this year are notable. The ongoing poor cane quality and lower sugar content in the harvest are key factors contributing to a more difficult situation for Thailand’s sugar sector. Sugar Exporters

Despite 80% of the cane crush being completed, the quality of sugar cane has dipped to its lowest level since 2016, with yields currently at just 10.9% sugar content. Several external factors are at play here: unusually high rainfall in the critical months leading up to harvest (September and October) and increased contaminants like mud and leaves affecting the cane. These challenges are expected to slightly hinder the total yield for the 2024 season.

Nonetheless, with Thailand on track to produce 8.1 million tonnes of sugar by the end of the harvest, there is still ample sugar available for both domestic use and export. This figure is sufficient to support the forecasted 4.7 million tonnes of exports, further cementing Thailand’s position in global sugar trade despite setbacks in quality. Sugar Exporters

Domestic and Export Price Surge: A Silver Lining for Exporters

One of the notable impacts of the poor crop yields is the surge in sugar prices. The rise in domestic and export prices has been driven by strong global demand and the constrained supply from major producing countries. Thailand’s exporters are benefiting from this price increase, which is offering a buffer against the lower yields. As a result, the revenue generated from sugar exports is expected to remain robust despite the challenges faced during the harvest season.

The global demand for sugar, particularly from key markets such as China, India, and Southeast Asia, continues to provide opportunities for Thai sugar exporters. High prices are likely to motivate more export activity, and the forecasted exports of 4.7 million tonnes will help meet the ever-growing global need for sugar.

Looking Ahead: Cane Prices and the Future of Sugar Production in Thailand

Looking beyond 2024, there is optimism surrounding the future of Thailand’s sugar sector. One key factor driving this optimism is the expected growth in cane prices for the 2024/25 season. The strong prices should act as an incentive for farmers to increase sugar cane planting, which could lead to a larger harvest in the next cycle. Additionally, sugar cane remains an attractive crop compared to other agricultural options like cassava, further supporting the potential for a larger sugar cane area.

High cane prices not only motivate farmers to plant more sugar cane but also contribute to the overall sustainability of the sugar industry. As provisional cane prices remain competitive, Thailand could see a rebound in the quality of cane and an increase in overall production in the near future. This trend could boost export potential and strengthen Thailand’s position as one of the world’s leading sugar exporters.

Conclusion: Thailand’s Strategic Position in the Global Sugar Market

Thailand’s sugar exporters are navigating a challenging yet promising landscape in 2024. While the global market is tight, and the local cane quality has suffered, the country’s export forecast remains strong, with a projection of 4.7 million tonnes of sugar. The surge in prices for both domestic and international markets offers some relief to exporters, while the potential growth in cane planting due to high prices signals a more favorable outlook for the future.

Ultimately, Thailand’s ability to adapt to market conditions and leverage strong export demand positions the country for continued success in the global sugar trade. For sugar exporters, the coming years hold potential for both challenges and opportunities, especially as high prices incentivize greater production in the years to come.

As we move forward, the Thai sugar export industry will remain crucial in meeting global demand, with the resilience of producers, the impact of favorable pricing, and the prospects of larger cane planting driving the future of this vital sector.Sugar Exporters